Understanding Cruise Port Fees And Taxes

Ever booked a seemingly affordable cruise only to be shocked by the final price tag? The truth is, the advertised price rarely reflects the total cost, and understanding the often-hidden world of port fees and taxes is crucial for savvy travelers. These charges, often bundled under an ambiguous umbrella term, can significantly inflate your vacation budget. Let's delve into the murky waters of cruise pricing and uncover the secrets lurking beneath the surface.

The cruise industry, a behemoth of leisure and entertainment, operates on a complex system of pricing that often leaves consumers bewildered. While the initial fare may seem enticing, a plethora of additional charges, often labeled as "taxes, fees, and port expenses," can quickly add up. These fees aren't arbitrary; they reflect a variety of costs associated with operating a cruise ship, from docking fees and harbor pilot charges to customs and immigration processing. But understanding the breakdown of these charges empowers travelers to budget effectively and avoid unpleasant surprises.

| Category | Details |

|---|---|

| Port Fees | Charged by local port authorities for the right to dock, covering services like pilotage, docking assistance, and port infrastructure maintenance. Vary by port and ship size. |

| Government Taxes | Levied by national and local governments, encompassing customs and immigration fees, security charges, and tourism taxes. Differ significantly based on itinerary. |

| Security Fees | Implemented after 9/11, these fees contribute to enhanced security measures at ports and on cruise ships. Relatively consistent across various itineraries. |

| Further Information | Cruise Critic |

Consider the port of call fees. Each time a cruise ship docks, the local authorities levy a charge on the cruise line. This fee grants the vessel the right to berth and utilize the port's infrastructure, including docking facilities and essential services. These charges, often passed on directly to the passenger, vary considerably depending on the port, the size of the ship, and the services provided. A bustling port with extensive facilities will naturally command higher fees than a smaller, less developed port.

Furthermore, the duration of the stay also plays a role. A brief stopover will incur lower charges than an extended visit. This is where meticulous planning and a deep understanding of your itinerary become essential. By researching the ports of call and their respective fee structures, you can anticipate these costs and factor them into your overall budget. Resources like Cruise Critic offer valuable insights into port fees and other hidden costs.

Beyond port fees, government taxes form another significant component of the final cruise price. These taxes, imposed by national and local governments, cover a range of services and regulations, including customs and immigration processing, security measures, and tourism development initiatives. These charges can vary widely depending on the itinerary and the specific regulations of each country visited. For instance, a cruise through the Mediterranean may involve taxes from multiple countries, each with its own fee structure. Similarly, cruises to destinations like Alaska or Hawaii often involve specific state taxes.

The aftermath of 9/11 brought heightened security measures to the travel industry, including cruising. Security fees, implemented to fund enhanced security protocols at ports and on cruise ships, are another factor contributing to the overall cost. While these fees tend to be more consistent across different itineraries, they still represent an additional expense that must be considered. Therefore, when comparing cruise fares, it's crucial to look beyond the base price and delve into the specifics of the included taxes and fees.

As highlighted by the recent cruise fee increase in Iceland, planned for 2025, these charges are not static. Changes in government policies, economic conditions, and infrastructure development can all impact the cost of cruising. The Icelandic example illustrates how rising fees can force cruise lines to alter their itineraries, potentially impacting travelers' plans. Staying informed about these changes is crucial for avoiding disruptions and managing your expectations.

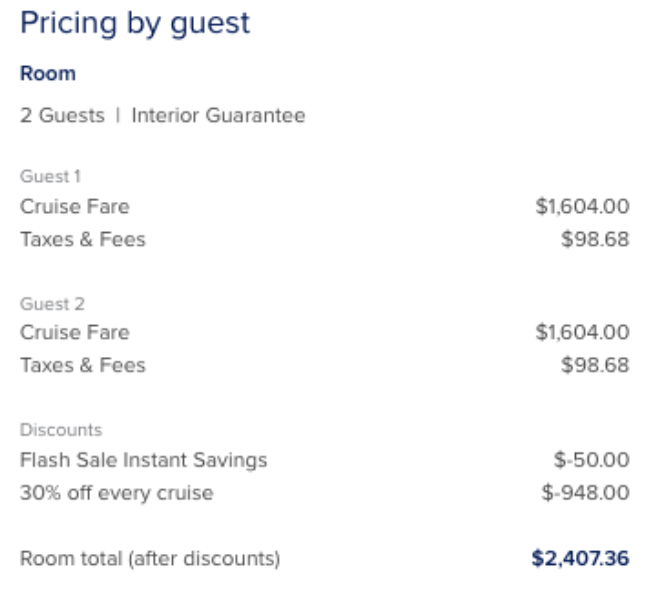

The cruise industry, like any other business, aims to maximize profits. This often involves advertising attractive base prices to lure potential customers, while burying the additional costs in the fine print. This practice, while not inherently deceptive, underscores the importance of thorough research and due diligence. Before booking, meticulously review the itemized list of costs, paying particular attention to the breakdown of "taxes, fees, and port expenses." This transparency allows you to make informed decisions and avoid the shock of unexpected charges.

Consider the example of a Mediterranean cruise. Depending on the specific ports of call and the countries visited, fees can range from $150 to $200 per person. This seemingly modest amount can quickly add up, especially for families or larger groups. Similarly, as one traveler discovered, a deeply discounted cruise fare of $998 per person can be accompanied by hefty taxes and fees totaling $751, significantly impacting the overall cost.

In conclusion, navigating the intricate world of cruise pricing requires vigilance and a keen eye for detail. By understanding the components of port fees and taxes, researching your itinerary thoroughly, and scrutinizing the fine print, you can unlock the true cost of your cruise and embark on your voyage with confidence and a well-informed budget.